Euroins — Digital Insurance Platform

Mobile-first insurance built for speed, trust, and compliance

Euroins, a leading European insurer, partnered with A7 to reimagine its digital channels.

Together, we launched a mobile-first insurance platform for travel and health products — powered by a configurable tariff engine, seamless user journeys, and full back-office automation.

Our Contribution

A7 managed the project end-to-end, combining business analysis, design, and engineering into one delivery stream. Key components included:

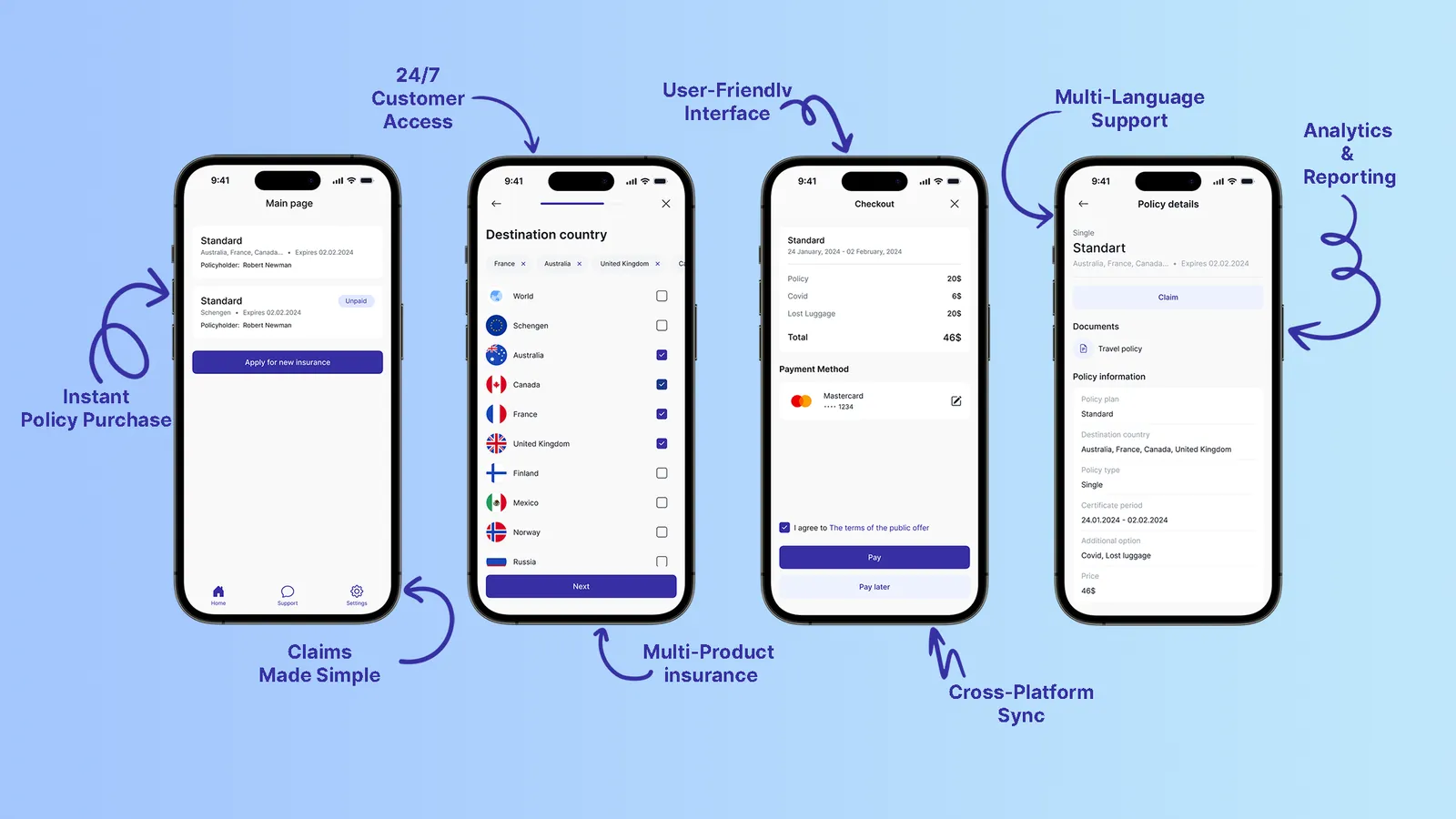

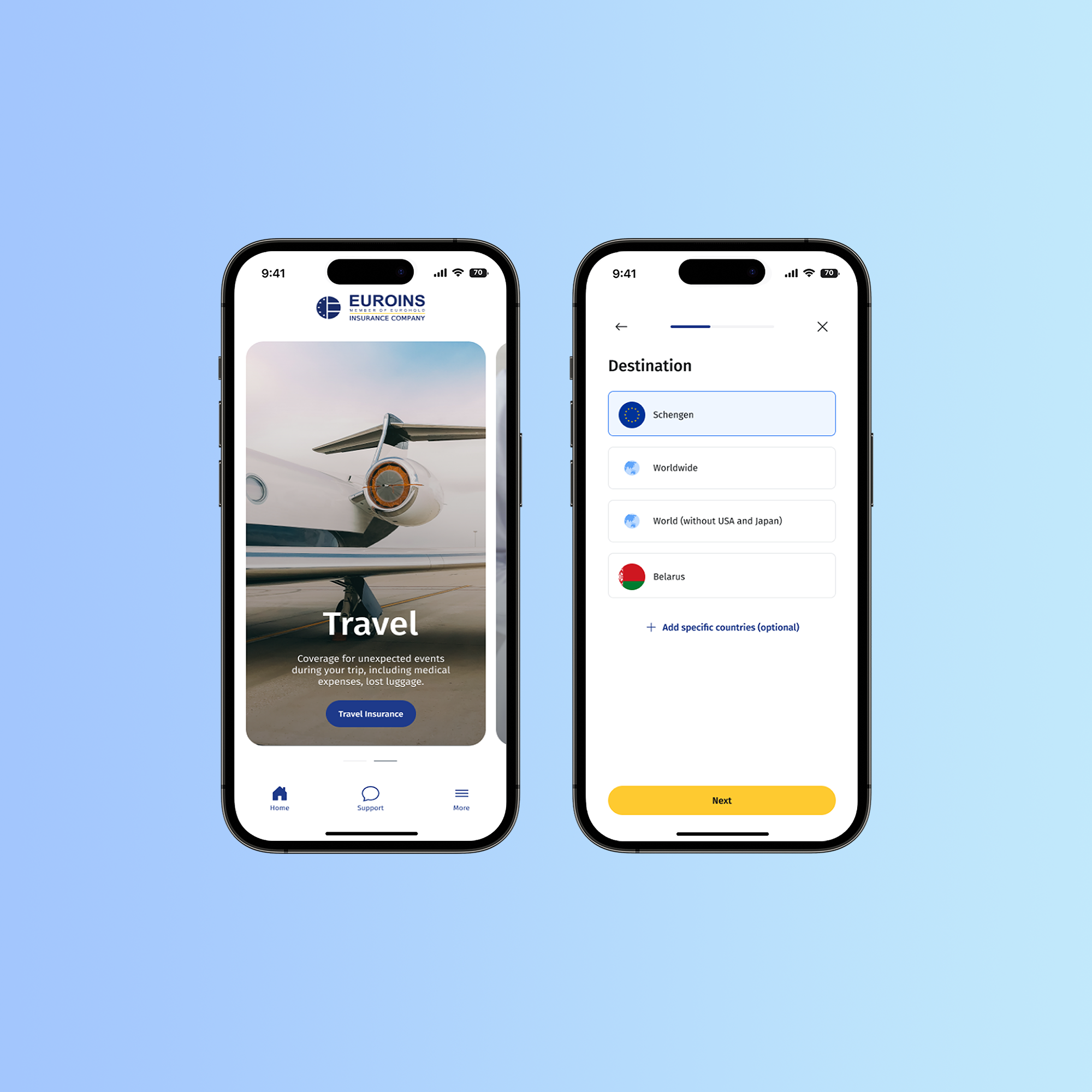

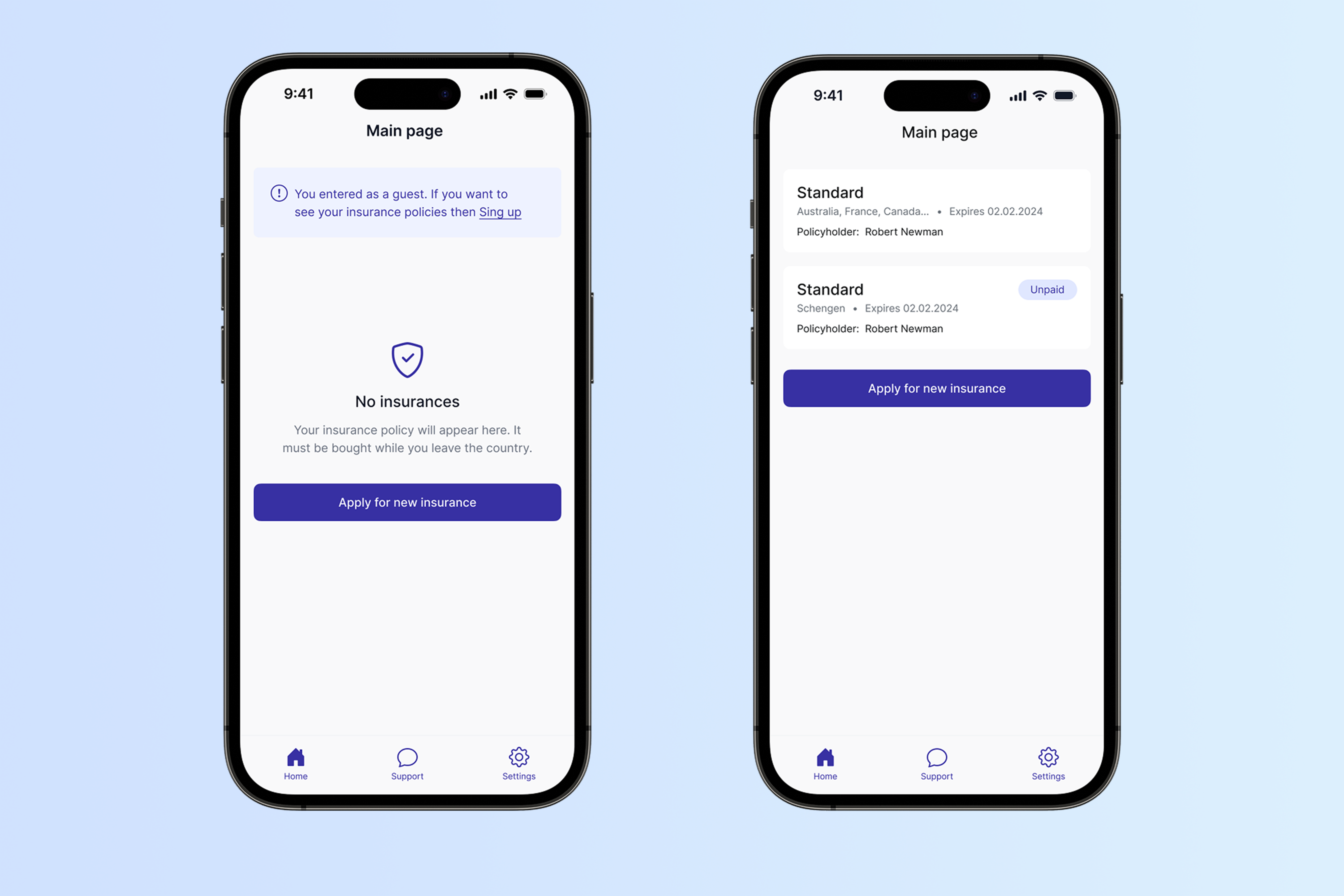

- Mobile application for quick policy purchase and management

- Tariff calculator with customizable pricing and rules

- Admin console for policy management, analytics, and support operations

- API integrations with external registries and partner systems

- Responsive design optimized for mobile-first digital adoption

Results

The platform enabled Euroins to:

- Cut onboarding time from days to minutes

- Expand into new digital sales channels

- Increase transparency and trust for both agents and customers

Today, the system is used daily by thousands of policyholders across multiple countries.

Discovery & Analysis

We began with a structured business analysis phase to ensure accuracy and compliance:

- Stakeholder interviews and market research

- User journey mapping — from quote to policy issuance

- Tariff logic defined by country, duration, age, and coverage type

- Technical requirements for registry and API integrations

By working closely with Euroins’ subject-matter experts, we transformed domain-specific rules into an actionable, prioritized backlog.

UI/UX Design

Insurance is complex — but the user experience doesn’t have to be. A7’s design team created:

- Mobile-first UX for fast and intuitive policy purchase

- Step-by-step wireframes covering quote → data input → review → payment

- Modular admin interface for support teams and agents

- Responsive UI designed for tablet and cross-device accessibility

Development & Architecture

Our agile development approach ensured rapid iteration and delivery. The platform includes:

- Native mobile apps for iOS and Android

- A custom tariff engine with flexible pricing logic

- Automated policy generation with timestamped PDF exports

- Secure payment gateway integrations

- Real-time admin portal for policies, users, and overrides

- Scalable backend designed for seasonal traffic spikes

Admin Panel

A7 built a secure and intuitive admin console that gives Euroins teams full control over policies, tariffs, and customer support workflows.

Key features include:

- Real-time policy search and management

- Tariff editor with configurable pricing rules

- User profiles with activity logs and manual overrides

- Analytics dashboards for sales and claims tracking

- Role-based access for compliance and security

QA & Launch

Quality assurance focused on compliance, accuracy, and resilience:

- Tested tariff edge cases and multi-country rules

- Validated payment and form error handling

- Verified accessibility and responsiveness across devices

- Supported UAT and trained internal teams before launch